- Your cart is empty

- Continue Shopping

H.I.A.P.E. 3.0 A.V.I. (Adaptive Volatility Identifier)

$500.00 $27.99

H.I.A.P.E. 3.0 A.V.I. (Adaptive Volatility Identifier)

Product Description

H.I.A.P.E. 3.0 (Artificial Intelligence) Forex Trading Robot

🟢Pair:Any Currency Pair

🟢Timeframe: 1M

🟢Minimum balance: 200$ USD

The H.I.A.P.E. 3.0 A.V.I. (Adaptive Volatility Identifier) Forex Trading Robot is a highly adaptive system that will manage your account based on active market conditions. It will execute trades within the london session and 8 hours into the session. After the U.S. trading session is over. The H.I.A.P.E. 3.0 A.V.I. will not allow any new trades but it will still manage the old ones. Which reduces your risk.

The H.I.A.P.E. 3.0 A.V.I. will automatically start at the london session and when the session is over, it will wait for the next session to start trading again. Making this a fully automated system. It will identify all of the above and learn from the immediate changes in the markets. Then use what it learned to adapt to the ever changing conditions in real time! When your target is hit, all trades will close and the algo will disable itself.

The H.I.A.P.E. 3.0 forex robot uses advanced machine learning technology. It’s artificial intelligence based functionality is highly adaptive to market conditions of all types. It reads the markets and adapts to changing conditions without you having to change any moving averages, atr settings, rsi settings, trend filters or even support or resistance levels.

The H.I.A.P.E. 3.0 is not counter trading and it doesn’t add trades for every 1 pip in profit. We don’t stack onto our losers like a martingale. Rather. It stacks on the winners and only trades the direction of the trend. It executes trades on market sentiment or it’s reaction to the wave oscillations.

The H.I.A.P.E. 3.0 EA will start stacking positions into the market as sentiment grows in strength toward a single bias. The Hedge Infused Phoenix executes stack trades. Based on the intermediate market trend and market sentiment. So simply put. If the market is dropping.

The H.I.A.P.E. 3.0 will start adding short sell positions into the market at every sell signal that it receives. As for profit taking and security of your account. Well you know. We use stop losses and it has built in exit signals just in case the market changes direction and hits our stops. Combined with a correlated hedging strategy, the Hedge Infused Assar Phoenix Elite gives you ultimate protection from account blowouts.

So you’ll have 5 to 10 trades open at any given time. Adding more pairs will multiply this by however many pairs are open. So you are increasing your risk. You need to learn how this robot works. And you need to learn risk management. Always keep your risk low. Follow my risk management plan and try not to trade so heavily.

The Hedge Infused Assar Phoenix Elite will stack trades in the direction of the market trend. So you don’t need to have lots of pairs open all at once. It will build a portfolio of positions within one pair. So don’t stress it if you only use one pair a time. You’ll still hit your target and stay safe at the same time. I would say, for the people who are new to forex. Just trade one pair. Pick one of the major crosses and stick to it for a period of months. Or even years. Get to know the country or countries if it’s the EU.

Since it will be attached to the USD, you can study just two economic systems.

This will save you a big headache. This will also give you a better opportunity to make more stable returns. You’ll understand that one pair alone and you won’t have to rely on any special tools. The H.I.A.P.E. 3.0 will immediately adapt to one pair by itself. It’s designed to enter and exit at the beginning and end of trends and ranges.

If you trade the EU alone, it doesn’t have a high range or high volatility very often. So it will be easier for the H.I.A.P.E. to adapt to the trends. Unlike trading the GA or GJ. The high range and volatility don’t make for stable trends. Since this system is a short to mid term trend following system. It will easily adapt to these major crosses. Very quickly.

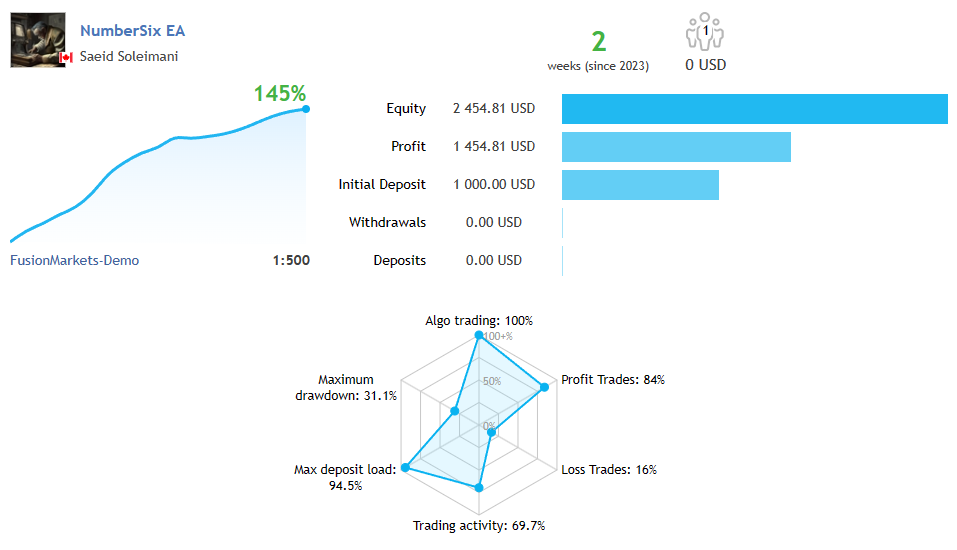

I first released the latest update to the public. December 1st 2022. When i present these tools to you guys. I try to make it as extreme and high risk as possible. So you guys know the highest possible potential these tools offer you. The H.I.A.P.E. 3.0 is not counter trading and it doesn’t add trades for every 1 pip in profit. We don’t stack onto our losers like a martingale. Rather. It stacks on the winners and only trades the direction of the trend.

One thing you have to do if you want to use a basket target. Is turn off the jump stop loss settings and break even settings inside of the HIAPE. Because you are using a basket target. So what happens when you are basket trading is this. You are opening a series of trades all at once and using those trades collectively to put you into enough profit to hit a specific equity target.

If you have profit locking for each individual trade you have. That trade will have it’s trailing stop loss triggered. And this will be one less trade to help you reach your equity target. The EA has a set target. And this target will get harder to reach as more of your basket of trades are closed.

So at one point, if you have 10 trades open at once. It will be easier to hit a 100 pip target. Verses if you have 5 trades open at once. Then it will take double the amount to reach it. So you will need to make sure you do not close any of your trades when you have a basket target. This is an equity target that you must reach.

If you want to day trade. Then turn off the basket targeting feature by setting it to a high number say like $50,000. This way your equity target won’t be triggered and you can trade individually instead of collectively as a basket.

Here’s a list of features within the H.I.A.P.E. 3.0 (A.V.I.) and (A.I.) versions:

Adaptive Volatility Identifier

The most common problem in forex is that we lose money due to low volatile markets. When the markets aren’t moving anywhere or when liquidity is low, due to risk-off sentiment. Most of us will trade at any point in time and the market will instantly reverse against us. We’ll get stop hunted, requoted and have to deal with spread spikes. Notice how when ever the market is really active, you do much better than when the market is slower?

Say for instance, some high impact news will be coming out and you end up in the market when the prices are actually moving and you make money. But if you try to do this again inside of a lower volatile market session, such as the Asian or Australian market sessions, then you lose most of the time?

This is because of low volatility. Which i have solved with this new equation. The Adaptive Volatility Identifier or A.V.I. for short. Trading when the market is not really moving anywhere is not a smart idea. You need volatility. Which typically means a liquid market. What does all this mean?

It means you need to wait for the market to be active, moving. This is why i designed the A.V.I. filter. So it will only allow trades when the market is active. So you have a much better chance at winning without having to try and identify market volatility yourselves. Don’t be impatient. Just wait and let it work.

You may miss some hours of trading. But in this way, you’ll gain profits easier with much less losses or drawdown in-between. So keep the A.V.I. set to true. Unless you are adept at identifying volatility yourselves. Adding to this: The prices could be moving or there may be a trend of some sort. But this doesn’t always means that the market is volatile.

You could see a trend and open trades in it and immediately get manipulated. So you’ll have drawdown and stop losses being triggered. Because the market is reacting to your volume. In these cases. You typically end up trading against your broker. Because the market isn’t liquid enough.

In some cases, you could open up a bunch of trades in low volatile market conditions, but you’ll have enough liquidity through your broker to not have any serious affect on supply or demand within your liquidity pool. So you’ll have other participants to trade with.

And your trades will not be affected. All of this can happen within your liquidity pool. Which is provided by your broker’s liquidity provider. Personally, I’d rather not take the chance that my broker’s liquidity pool will actually be liquid. That’s why the A.V.I. exists. It reads the open market and doesn’t play with broker’s directly.

Also. The H.I.A.P.E already has a built in system for identifying strength of trends and trend direction. It can also identify sentiment. So it’s already filtering market conditions. The A.V.I. was added in because the H.I.A.P.E doesn’t directly read volatility. And it has trend and trend strength confirmations for it’s signals.

So you will not see any trades until there is a confirmed trend with confirmed trend strength, in an active and volatile market. This will assure much more profitable outcomes. 95% of the time.

H.I.A.P.E. 3.0 (A.I.) Artificial Intelligence Features:

Adaptive Average True Range Filter

An ATR filter that will adapt to changing market conditions. There is a base period and previous candle settings that will auto change and adapt to the market. You can activate auto adaptations or you can disable them to use the original ATR indicator.

Auto Adaptive Bollinger Bands Filter

The Bollinger Bands have been modified to auto adapt to market conditions in realtime. You can activate auto adaptation to the market or you can turn it off and use the default/original bollinger bands indicator.

Auto Adaptive RSI filter

The Relative Strength Indicator has been completely modified to adapt to market conditions in real time. You can activate the auto adaptations without worrying about changing any settings. Or you can use the original/default RSI.

Auto Adapt to changing market trends

No more worrying about trend direction or constantly changing your moving averages or trend filters. The auto trend adaptation will completely modify itself based on live market conditions. Automatically decreasing or increasing the filters based on the ATR fluctuations in the markets.

Auto Adaptive Support and Resistance levels

This amazing function will allow the HIAPE 3.0 to identify support and resistance and only allow trading when the prices have closed above or below resistance or support with confirmation. It will also identify retesting of these levels and automatically allow or deny trade signals if there are no breakouts or false breaks.

Slippage and Spread Filter

You have the option to pick how tight or loose your slippage will be. This is so your trades will be executed more smoothly by your broker. The spread filter will avoid any high spread pairs, allowing you to save money and earn more profits.

Hidden Stop Loss

I had to hide this because there are brokers and banks who are dying to know where your stops are. So they can stop hunt you. However. The risk management i’ve hard coded into the HIAPE 3.0 will allow for an emergency stop loss.

Hidden Trailing Stops

The HIAPE 3.0 will automatically start trailing your profits in each currency pair based on my management plan. This also i cannot expose to anyone. This is a safety measure to prevent banks and brokers from manipulating our positions.

Economic Calendar Filter attached to the forexfactory.com

Avoid high impact, low impact, medium impact, public speeches and holidays.

London/US session filter

(Only allow trading for 8 hours after the open of the London market. This is set to 10:00 which is standard for most brokers. I left this configurable just in case your broker time zone is different from the majority.

Equity Basket Target

Set the dollar amount you want to take profit at. When your equity reaches positive at this exact amount. All of your trades will be closed. You have the option to disable trading or allow trading after this.

Auto Calculate the lot size

Based on your equity amount, which is configured as follows: 0.01 lots for every $1000. Anything below $1,000, keep your lots at 0.01.

I’ve compiled a list of currency pairs that are best suited for basket trading during the london session. You can trade all of these pairs or you can just pick a few of them. It’s up to you and it’s also up to how much the market is moving. Personally, i prefer more diversity so i would use all of the crosses.

These pairs typically get around 30 – 60 pip ranges every trading day. So depending on your preferred return every month, you’ll need to decide your lot sizes and how much profit you need to make every day. I’ve already explained exactly how to do this in my educational video.

In the training video, i explain exactly how to calculate your lot size, how many pairs and how many pips you need per day in order to reach a monthly goal. It’s very easy to follow. I strongly suggest you follow and study the training video! Now here are the top list of trading pairs for the Hedge Infused Assar Phoenix Elite Forex Robot. You can find the training and educational video just below:

EURUSD: The EURUSD pair, consisting of the euro and the US dollar, is one of the most popular and widely traded pairs in the forex market. It offers excellent liquidity and tends to exhibit stable trends, making it an ideal choice for consistent income. Furthermore, as the European and US economies are major players on the global stage, studying these two economic systems will provide you with valuable insights and enhance your trading decisions.

AUDUSD: The AUDUSD pair, composed of the Australian dollar and the US dollar, is another suitable choice for consistent profit and safety. Australia’s robust economy, coupled with its strong ties to the Asian market, often results in predictable price movements and favorable trading conditions. This pair offers a balance between volatility and stability, making it appealing for traders seeking reliable returns.

GBPUSD: The GBPUSD pair, representing the British pound and the US dollar, holds a prominent position in the forex market. It offers ample trading opportunities and attracts significant market attention, ensuring sufficient liquidity. While it may experience occasional volatility, the GBPUSD pair presents well-defined trends that can be effectively navigated with proper analysis and risk management.

NZDUSD: The NZDUSD pair, comprising the New Zealand dollar and the US dollar, provides an opportunity for consistent income with relatively lower risk. New Zealand’s economic stability, coupled with the influence of the US dollar as a global reserve currency, contributes to a well-defined and manageable trading environment. By focusing on this pair, you can take advantage of its consistent trends and build a solid foundation for your trading success.

USDCAD: The USDCAD pair, featuring the US dollar and the Canadian dollar, presents an attractive option for consistent profit and risk management. Canada’s close economic ties with the United States and its status as a major oil producer often result in predictable price movements and reliable trends. By understanding the factors that impact these currencies, you can make informed trading decisions and achieve your desired income goals.

USDCHF: The USDCHF pair, representing the US dollar and the Swiss franc, offers stability and low volatility. Switzerland’s reputation for economic stability and the safe-haven status of the Swiss franc make this pair suitable for risk-averse traders. The USDCHF pair often adheres to technical patterns and exhibits smooth trends, allowing for consistent profit potential.

USDJPY: The USDJPY pair, consisting of the US dollar and the Japanese yen, is one of the most traded currency pairs globally. Japan’s economic influence and the US dollar’s status as a major currency create an environment that favors consistent profit potential. This pair often exhibits well-defined trends and can provide opportunities for steady income generation.

It’s all about good timing. During the London market at tradersway I turned $3 into $108. I lost it because I kept going back in. But if I had waited till the next london open and tried again, I would have won every day. This is the last step.

Just disciplined trade times. That’s it. Once per night. But the compund is insane. Look at my analysis and trade history. You’ll see why and where and how this works. And you can see from that what I should be doing right and what I’m doing wrong.

The brokers do manipulate the markets but during the London open we have a chance. Because of very high market activity. It’s all in black and white in the group. I’ve explained myself very thoroughly. I made $260 that night I recovered from the HM. That was the work of the Phoenix. I didn’t just find the holy grail. I invented it.

Before you put any of my robots into a live account just make sure you understand market conditions and market structure. There is no cookie cutter method to trading. So take my advice with a grain of salt. I can only guide you so far. When you’re in the market It’s just you against the banks.

You need to adjust your risk, trade time, etc.. My robots do not predict price action. They only trade when you tell them to. These are just tools to make trading easier for you. They are not the end of all. You still must understand economics and market structure. You must understand how to trade. You can’t escape using your brain. You have no choice.

When the account is in profit, the panel will turn green. When it’s negative, it’ll turn red. You can see how many trades are winning and how many are losing as well as your total basket profit loss. This is great for back testing.

I would highly recommend if you are a beginner that you guys keep your risk low. The H.I.A.P.E forex trading robot will open 10 to 20 trades at a time. So. Stick to just one or even up to 5 pairs for every $100 in equity. You truly only need one pair to earn a stable and consistent income.

Just trade one pair and compound your lots. 0.01 for every $1000. Simple as that. You may also set it to only take one trade at a time until that trade exits at the exit signal. Or at your stop loss or take profit. Just change the amount of allowed trades and pending orders to your desired amount.

ONLY TRADE AFTER THE LONDON OPEN!

Start the H.I.A.P.E. 3.0 after 12:00AM PST. You must make sure you start the HIAPE at the london open. 12:00 AM PST. Or within 30 minutes. Or else you miss the move.

I recommend you do not allow it to start trading after 2 am PST.

After you hit your first target. Stop trading and wait for the next london session. DO NOT TRADE AUSSIE, ASIA OR ARABIC MARKETS!

Put the H.I.A.P.E. 3.0 into the 5m Time Frame. When using the stop loss and take profit settings in the H.I.A.P.E. 3.0. If you do not want to use a stop loss or take profit. Set it to 90000 for each. If you set it to 0, it will close your trades instantly.

How do you build a solid risk management plan?

To measure the risk per trade, you would typically use the price chart and set your stop loss level, which is the point at which you would exit the trade if the market moves against you. This is either measured by a 1 to 3 ratio in which you would take 1 loss for every 3 profitable trades.

Today i’m going to teach you how to calculate a 2% risk management plan. After you understand this simple method, you’ll have a better understanding of risk management and how to utilize it properly.

For Example:

If you have $5,000 in your trading account and are trading mini lots, where each pip is approximately worth $1, your risk for each lot would be $50 (50 pips x $1 per pip). By limiting your risk to $100, you could trade one or two mini lots. To adhere to the 2% rule, you should not exceed three mini lots in this example.

Calculate the difference in pips between your entry point and stop loss level (e.g., 50 pips). If you’re trading mini lots (where each pip is approximately worth $1), multiply the number of pips by $1 to get your risk per lot (e.g., 50 pips x $1 per pip = $50).

Trade one or two mini lots to keep your risk within the maximum allowable loss (e.g., $50-$100). Avoid trading more than three mini lots to stick to the 2% rule.

By following this basic formula, you’ll be able to create profitable risk management plans to combine within your trading strategy. The 2% rule has been used worldwide and shown exceptional results.

Here is a Hedge Infused Assar Phoenix Elite risk management plan. Based on daily targets. The compounding strategy is based on a 1% risk profile. For every $1000 you’ll set your lots to 0.01, and your target $10. It works like this:

$100 in equity

0.01 lots

$10 profit target

==============

$1000 in equity

0.01 lots

$10 profit target

==============

$2,000 in equity

0.02 lots

$20 profit target

This target can be revolving which means, you can let the HIAPE run all day and it will continuously hit your target. Or you can make this a one time target by configuring the settings within the Hedge Infused Assar Phoenix Elite.

Reviews

There are no reviews yet.