- Your cart is empty

- Continue Shopping

Product Description

Auto Recovery Manager MT4

- Experts

- Ianina Nadirova

- Version: 3.20

- Updated: 30 March 2023

- Activations: 10

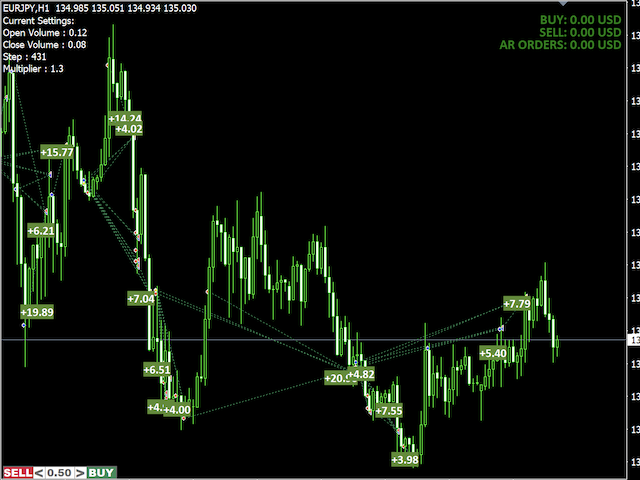

Auto Recovery Manager is a system for tracking and recovering drawdown from other Expert Advisors. If another EA generates the specified drawdown, ARM will turn it off, lock the position and start the process of restoring the position using a partial close. The EA uses smart averaging, locking and partial closing in its trading.

It has an automatic dynamic tuning system. This means that the trader needs to choose the levels of risk to be used, and the EA will adjust the variables on its own. To calculate the variables, the EA uses data on the free margin of the deposit, as well as on the market volatility at the moment. When part of the drawdown is restored, the EA will continue to update the input settings data so that the activity matches the current volatility and deposit opportunities for opening positions. It is also possible to adjust all the values yourself without using auto-tuning.

Instruction – https://www.mql5.com/en/blogs/post/749927

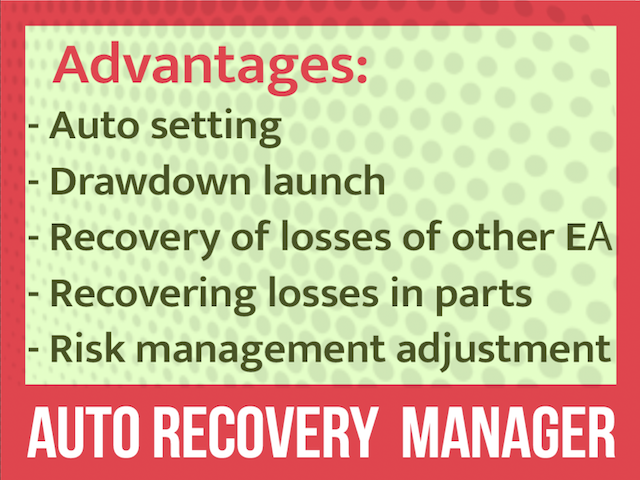

Advantages:

- ARM can set variables itself, you only need to select the desired risk level

- Can restore individual Expert Advisors or orders opened manually

- Can be used to automate tracking, averaging and closing manually opened orders as a tracking system

- Able to turn off other advisers and work in drawdown standby mode

- Has no unnecessary settings and is easy to run with a huge automated functionality

How to run an adviser:

If ARM will be launched to accompany another EA – place them on the same terminal or VPS. If you will launch the Expert Advisor during a drawdown, test the risk modes in advance, before connecting ARM in standby mode.

Before starting, add an adviser to the chart – it will calculate the settings. Next, these settings need to be launched in the strategy tester, see how the adviser works in the selected settings, in order to, if necessary, make a final risk adjustment before launching.

Important nuances:

- If you use locking, it is better to disable other advisers.

- Before launching ARM, it is better to read my recommendations and test the EA. ARM adjusts the risks itself – data on the current settings is displayed on the Expert Advisor panel.

- For testing with automatic tuning, it is better to use the H1 timeframe. ARM uses volatility indicators from the H1 timeframe to automatically calculate the step.

Testing:

For testing, run the tester in the “Visualization” mode.

Open orders using the ARM panel for the EA to restore them.

To test the drawdown, set its value in the input variables and open orders using the panel, when the drawdown reaches the specified one, ARM will start recovery.

Test different risk modes before running in real work.

It is advisable to start using a demo account in order to understand all the nuances of the product.

If you have any questions about the settings – do not hesitate to write to me, I will definitely tell you.

208

After testing in a live demo account and now a real one, I can confirm this is an EXCELLENT job. I am enjoying the convenience of Step Mode – Open by New signals in H1 or H4. It avoids opening counter trend orders and when pulling back it opens them. Recommend to test in one direction only with high take profit, 250 pips for instance, the EA is set to vary the take profit according the price action and I see if trend is in our favor it can take much more. Also it manages and cancels in profit opposite positions when there is an spike or opporttunity. I could describe many conveniences but the truth is this is between the best tools I bought in several years here.

248

ellena1026 2023.03.22 09:24 #

Amazing ea !!! I love it so much . This is best ea ever! thx u very much

2057

Wolfgang Rockert 2023.03.15 12:01 #

Yes, works very well, use low risk and all works fine… Close already some bad trades in profit..

Reviews

There are no reviews yet.