- Your cart is empty

- Continue Shopping

Product Description

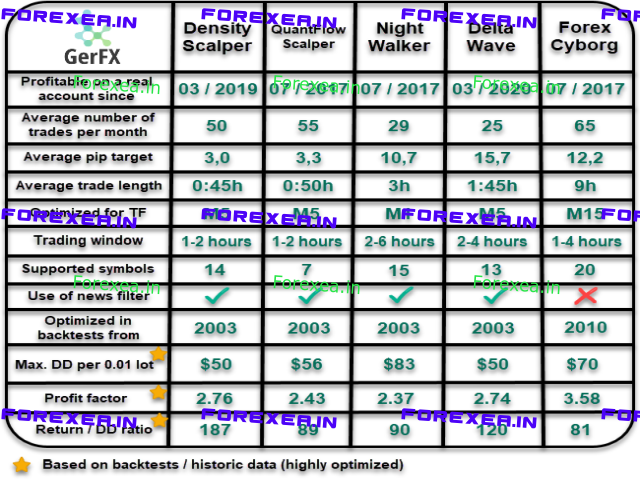

GerFX QuantFlow Scalper (

NY Close Scalper)

Before you buy a night scalper please be aware of the risks involved:

1) Past performance is no guarantee of future profitability (the EA could also make losses).

2) The backtests shown (e.g. in screenshots) are highly optimized to find the best parameters but therefore do not give a realistic prediction of future profitability.

3) Any mean reversion can get caught on the wrong side of a fast movements due to unexpected news or flash crashes. This strategy will always use a stop loss, but still execution of the SL depends on your broker.

4) Night scalpers are dependent on good brokerage conditions, like low spread and slippage, which might be worse on high lot sizes.

This is a mean reversion strategy around the close of the New York session. It does not use martingale or grid and uses fixed stop losses for every position.

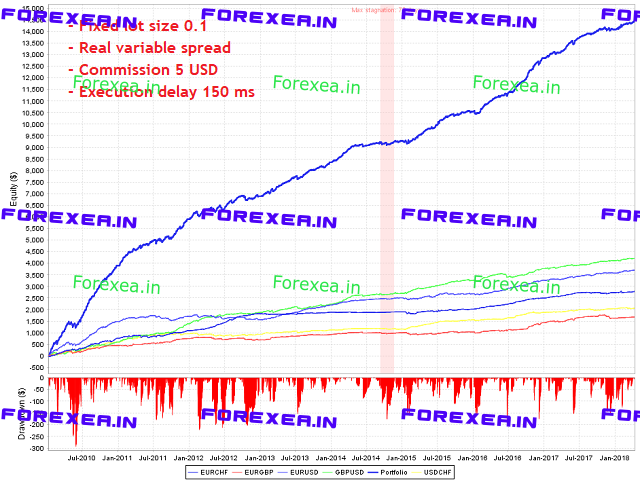

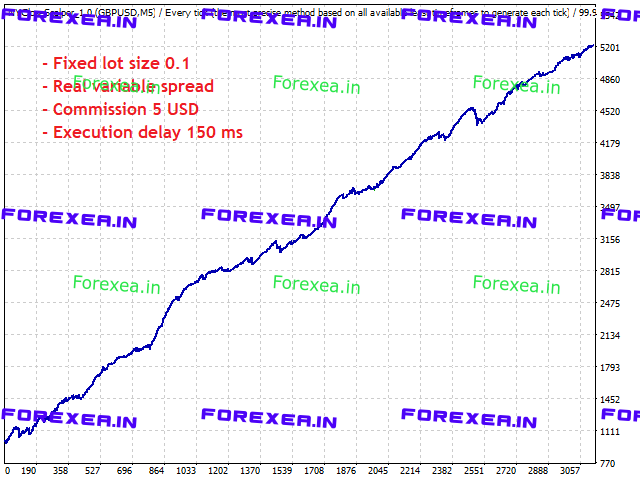

Symbols: EURUSD, GBPUSD, EURCHF, USDCHF, USDCAD, EURAUD, EURCAD

Time frame: M5

Max. drawdown in 16 year backtest: $56 per 0.01

Live monitoring (my signals are also using the breaking news filter)

Additional information and backtests

Please read the blog post for instructions on how to set up the EA.

Because the EA will trade around the New York close time (16:00 – 18:00 New York time), the GMT time will be different in summer compared to winter (DST: daylight saving time). But the EA has daylight saving times stored internally, so there is no need to adjust the trading hours manually.

The EA should run on a VPS continuously without interruption (also Friday evening) to store the historic data.

Please allow web requests to the following URLs for the calendar news filter and automatic GMT offset calculation:

- http://fxdata.cc

- http://backup.fxdata.cc

- http://breaking.fxdata.cc (only needed if you use the breaking news filter)

For backtest it is important to have the correct GMT settings. Ideally, backtests should be done with Tick Data Suite GMT+2 with US DST.

Because this strategy is trading around swap time the spread can be very large. It is important to use real spread in backtesting and not some fixed spread. But be aware that the spread can be very different between brokers at that time.

The EA should be turned off on days of important events, for example general elections in UK, US or Europe!

Parameters

- dailyEquityStopPercentage: IMPORTANT: please read point 6 in the blog post.

- orderComment – Each trade will show this comment in history tab.

- magicNumber – individual magic number. The EA will only manage position of the chart symbol with this magic number.

- lotType – “fixed” or “increasing”, where the lot size is calculated automatically.

- fixLots – fixed lot size in case lotType = fixed.

- lotStep – how much the lot size should be increased every equityPerStep (if lotType = increasing).

- equityHardStop – if the equity falls below that level the EA will close open positions (only of this strategy) and will not open any new positions.

- pipInPoints – for 5-digit brokers, this should be 10, for 4-digit brokers 1.

- slippagePoints – Slippage used in OrderSend() function (points, not pips).

- maxSpreadPips – maximum spread allowed for entry. If smaller 0, auto settings will be used, which are different for each currency pair.

Time Settings

- liveGMToffset – To set GMT offset manually. Usually this is not needed.

- waitMinutesBetweenSameSideEntry– After a buy position another buy position will only be allowed after the given time. Same for sell positions. If you are sleeping during the trading hours you could limit the potential total risk with this parameter. If the last hour was a loss the EA will automatically increase waitMinutesBetweenEntries by 15 minutes.

- dontTradeTripleNegativeSwap – If true, the EA will not open trades on before swapHourGMT when the swap is negative on days with triple swap rate.

- tripleSwapDay – Day at which tripple swap is applied. On most borkers it is Wednesday.

- swapHourGMT – Swap hour used if dontTradeWednesdayNegativeSwap=true.

- testerGMToffset – Only needed for tester because GMT time is not defined in tester and your bar data might have a GMT offset.

Please also have a look at the “What’s new” tab for additional parameters.

Quantflow = New York Scalper

admin –

good