- Your cart is empty

- Continue Shopping

Product Description

Hydrangea

Seller

|

EA Name | Hydrangea |

| author | Kintuppa | |

| Currency Pairs | USDJPY | |

| Time Axis | 5-minute bar (M5) | |

| Trading Style | Day Trading | |

| Maximum number of positions | 1 position per side | |

| Backtest Period | 2010.02.01 – 2020.05.17 | |

| Double Building/Nanping/Martin | None/None/None |

Trade performance (forward)

Backtest (click to learn more)

EA Description

【Introduction】

▽SL30 setting, which is rare in anomaly EAs

My lot setting is such that when the maximum SL (stop loss) comes, the loss will be within 1~3% of the funds. I think there are many people who manage lots like this, but EAs with a wide SL such as 100 (many in commercial EA) have no choice but to drop the inevitable lot. If you take a 100% risk for 2 million yen, SL100 will be operated in 0.2 lots, and SL30 will be operated at 0.66 lots. This difference is directly linked to the difference in profitability.

As those who have bitten into EA creation will know, it is very difficult to create a high-performance EA with a low SL. Since the SL of a general commercial EA is set at close to 100, the results of the backtest look better if the SL is deepened (PF, total revenue, etc.).

However, when considering actual operation, there is an advantage that the lot can be increased, so even if the backtest looks a little worse, I would like to operate an EA with a low SL. Since it has a low SL and moderately cuts losses, the timing of operation is bad like commercially available Kotsudoka EA, and if you subtract DD at an early stage from the start of operation, you will not be able to recover for several months or years.

As mentioned above, this EA emphasizes practical benefits rather than appearance.

“It’s not a commercial EA made to sell, it’s an EA made for myself to earn!”

【What is Anomaly EA?】 】

It may differ from anomaly in the strict sense, but my definition is that it is an EA that aims at characteristic price movements in a specific time zone of a specific currency pair according to supply and demand. Since there is a law in the sense of direction, if you follow the flow, the winning rate is good. In addition, since the price movement is due to actual demand, it is difficult for the superiority to fade.

【What are the weaknesses of anomaly EA?】 】

Due to the above characteristics, reproducibility is very high, and there have been many such as mid-range prices for a long time. However, since anomaly EA aims for the direction depending on the time zone, there tend to be many “entry at a specified time” and “settlement at a specified time”. In the case of such specifications, there are drawbacks such as “entry timing and settlement timing become sloppy”.

Therefore, in this EA “Hydrangea”,

➀ Even if it is not the specified time, enter when the technical advantage situation becomes

(2) Even if the designated time comes, if the situation is technically difficult, the entry will be postponed.

(3) Settlement based on multiple factors such as time settlement, TP settlement, and technical settlement

We have come up with a solution such as: In this way, we tried to maximize the strengths of Anomaly EA. Furthermore, by combining the mid-market price and gotoubi anomaly with the supply and demand elements of the week and month, profitability has increased dramatically!

【About Specifications】

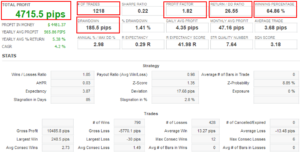

Despite the low SL30, the EA “Hydrangea” excels in all aspects, including a win rate of 65%, risk reward of 1, and PF of 1.82!

* The following data are verified at Tick Data Suite Variable Spread 2012.1.3~2020.4.24

My personal feeling is that EA with a stable balance of win rate risk reward has a long lifespan. One of the numbers I look at when judging EA performance is the return / DD ratio. Simply put, this is the total earned PIPS divided by the maximum DD. The higher this number, the shorter the drawdown period, the higher the profitability and the faster the recovery.

Hydrangea is giving out a value of 26.55, which is difficult to beat with one positive EA. This means that we are generating 26.55 times the maximum DD. The number of trades is about 120 times a year, and 10 times divided by month, so it will be about 2 ~ 3 times per week. THE MAXIMUM DRAWDOWN IS QUITE LOW AT 185 PIPS IN A BACKTEST OF MORE THAN 8 YEARS, AND I THINK THAT IT IS AN EA THAT CAN BE OPERATED WITH A SENSE OF SECURITY.

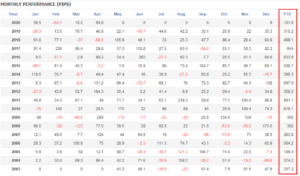

There are no annual losses and fewer monthly minuses. When there are many negative months, you will be mentally exhausted and want to stop the operation. Hydrangea ended in positive territory for 2012 out of 2020 months from 5~May 100.

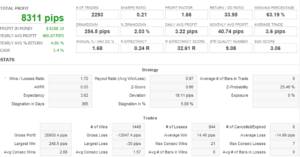

[High score even in long-term backtest from 2003]

* The following data are verified at Tick Data Suite Variable Spread 2003.5.5~2020.4.24

We have been optimizing since 2012 thinking that “there is no point in fitting the old market price where the environment is too different”, but the performance has been acceptable even in the backtest since 2003. I believe that this logic will prove that it is universally accepted.

Stability without annual negative balance even in long-term backtests! !!

Reviews

There are no reviews yet.